Group Captives 101

Captive insurance isn’t just for large corporations – group captives give midsize companies access to the many advantages of using an alternative risk management strategy. Learn more about the group captive model and how stop-loss group captive insurance could benefit your company.

What Is a Group Captive Insurance Company?

A captive insurance company is formed for the purpose of providing insurance to its parent company or companies. Large corporations have been using captives for many years to reduce and stabilize their insurance costs, gain greater control, and, in some cases, act as an additional profit center for the company.

Captives can provide game changing advantages when their owners manage and deploy them correctly. The explosive growth in the captive industry over the past three decades has transcended the hard and soft insurance market cycles. The industry has grown from a little over 1,000 captives in the early 1980s to well over 8,000 captives today.

Group captives give middle-market companies access to benefits that large corporations have been enjoying for many years. A group captive is a reinsurance company formed on behalf of a group of policyholders/members to insure a predictable layer of risk. Whereas single-parent captives are wholly owned by a single company, group captives are owned by multiple companies that band together to achieve better leverage and claims control.

Group captives have been around since the late 1970s and came to prominence during the hard market of the mid-1980s. Since then, there has been tremendous growth in this risk-financing approach for middle-market companies.

What Are the Benefits of the Group Captive Approach?

The National Association of Insurance Commissioners (NAIC) says approximately 90% of Fortune 500 companies use captive insurance subsidiaries. This is a testament to the advantages of the captive model. A group captive program lets midsize companies enjoy the benefits of this model.

The key benefits of a group captive program are:

Understanding Risk Insights Provided by a Group Captive Service Provider

Group captive services offer a wealth of risk insights that are crucial for enhancing member safety and minimizing losses. These insights help members:

With these insights and resources, members can not only manage their current risks but also anticipate potential future challenges.

Stop-Loss Group Captive (Medical/Benefits Coverage)

Stop-loss insurance provides coverage for large medical claims. Self-insured organizations use it to gain a critical layer of protection.

Many companies have realized they can control their losses and costs better when they act as their own insurer and self-fund their coverage. This works well for predictable and manageable claims, but there is always a risk that an unexpected catastrophic claim will threaten the organization’s financial stability.

Stop-loss insurance provides coverage for medical claims that exceed a pre-determined threshold, acting as a safety net for self-funded organizations.

Stop-loss group captive insurance is a practical way for midsize companies to access medical stop loss insurance. Multiple companies band together to increase their leverage and pool their claims history for superior risk management.

To see how stop-loss group captives help companies manage their costs, consider this scenario:

A midsize company with 100 employees uses self-funded health insurance to provide coverage for its employees and their families. The company also has wellness plans that encourage employees to exercise, quit smoking, and manage their diabetes risks. The company succeeds in controlling its losses and pays less than it would in the traditional insurance market while exercising greater control over coverage. Then, one of the employees is diagnosed with cancer and will need expensive surgery and chemotherapy. A week later, the wife of another employee suffers a stroke and requires a long hospital stay followed by months of rehabilitation. These two claims are too expensive for the midsize employer to cover, but, thankfully, the company is part of a stop-loss group captive. The stop-loss group captive covers the claims after the company reaches a predetermined manageable retention limit.

The ARU Group Captive Model

ARU has a unique group captive model, based upon 30+ years of experience of working with many different group captive insurance companies. The ARU approach minimizes volatility while maximizing profit potential. Our group captives offer middle-market companies coverage for workers’ compensation, general liability, and commercial auto coverages. We also provide coverage for property insurance and health benefits through specially designed group captives. All ARU captives provide 100% ownership of investment income and underwriting profit to the insured group captive members. All services are custom designed to benefit the members.

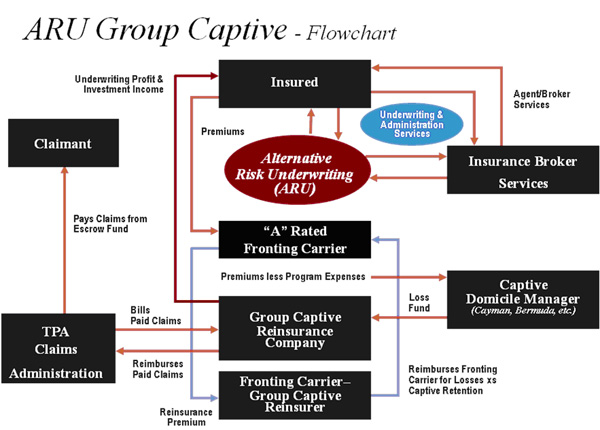

The following flowchart shows the various components of our group captives. We provide all the services on an unbundled basis, where group captive members select the best service providers for them. This provides flexibility, stability, and diversification for the captive members.

In addition to this flexibility, our members gain access to a wide range of expert services crucial for robust risk management and insurance solutions:

This comprehensive suite of services empowers our group captive members to thrive in today’s dynamic economy, leveraging both customization and state-of-the-art expertise to meet their unique needs.

ARU employs a sophisticated underwriting and rating approach to qualify potential members. Once potential members are thoroughly underwritten (based upon their loss experience, safety programs, and financial condition), we send them to the group captive new business committee for final approval. All ARU group captives have an executive committee and various sub-committees populated by the member policyholders.

We always base premiums for the members on their own loss experience plus expenses for reinsurance and fixed costs. In our member-owned group captives, we never base pricing on insurance industry market cycles.

Why Choose ARU for Group Captive Services?

Choosing the right provider for Group Captive Services is crucial for maximizing the benefits of this innovative risk management strategy. ARU offers tailored solutions across a variety of industry sectors, bringing expansive expertise and a proven track record.

We are a completely independent company , which means we can make all of our decisions focused upon benefiting our clients with no conflicts of interest. We do not have any outside sales pressure that might cause us to accept a company that is a sub-par risk. We manage a diverse array of programs and cater to numerous member companies. This breadth & depth of ARU’s experience ensures that we understand unique industry needs. Services include an underwriting approach where we craft a structure that perfectly aligns with your business’s risk profile.

Our dedicated team brings innovation and ensures your business benefits from the latest insurance strategies in a fast-changing economy. Ultimately, choosing the right group captive provider means aligning with an ally committed to delivering efficiency and excellence in risk management.

Is a Group Captive Program Right for Your Company?

A group captive insurance program may be a good fit for your business if you have more than 50 employees and your business is paying more than $250,000 in primary casualty insurance premiums. Good risk management is also critical. To qualify for group captive membership, your company must follow good safety practices and demonstrate financial stability.

Steps to Join an ARU Group Captive

If your business meets these criteria, the next step is understanding how to join a group captive. Here’s a streamlined process to guide you:

By following these steps and working closely with industry professionals, your company can effectively navigate the process of joining a group captive, ensuring it’s the right strategic move for your business.

Are you interested in exploring the benefits of a group captive insurance program? Contact us or learn more about our captive services.